Enterprises operating globally often deal with multiple currencies!

Handling currency conversion when dealing with large transaction volumes poses significant challenges to enterprises. Best Currency APIs come into play to ensure enterprises can operate smoothly in the global market with timely and accurate currency conversion.

If you are a business development management specialist who wants to facilitate accurate financial reporting and enhance risk management, choose the right Currency API that aligns perfectly with your enterprise’s needs. The best API integrates smoothly, provides accurate and current exchange rates, has reliable uptime and performance, and offers good value for money to enterprises.

This blog will help you evaluate the best currency API for your enterprise that will address potential risks and increase operational efficiency and financial accuracy.

Table of Contents

Key Considerations for Evaluating Currency APIs

Selecting the right Currency API for your enterprise is not as easy as it seems. Several important factors should be evaluated before choosing the best API for your enterprise, including:

- Data Accuracy and Reliability: Enterprises deal with inaccurate exchange rates that can lead to potential losses. Therefore, choose an API with real-time updates and strong data validation processes for effective risk management and financial planning.

- API Performance and Scalability: Enterprises often face fluctuations in transaction volumes. To manage these challenges effectively, select an API that can handle high request volumes and scale to accommodate your enterprise’s evolving needs.

- Security and Compliance: Data breaches and financial penalties are common concerns in enterprises. Opt for an API that meets stringent security standards and incorporates robust authentication protocols to protect sensitive financial information.

- Customization and Flexibility: Some APIs follow a one-size-fits-all approach, making it difficult for enterprises to align with their specific workflows. Choose an API that offers customized and personalized solutions to meet your enterprise’s unique needs.

Mitigating Risks When Switching to a New Currency API

Switching from one currency API to another is challenging for enterprises. They have a primary concern about data loss during the exchange process. Therefore, careful planning and understanding are needed to minimize risks during the API migrations.

Data Migration and Integration

First, identify the data type to be migrated to the new Currency API. Then, develop a migration plan that covers data backups from the previous systems.

Conduct a pilot migration with a subset of data to test the process. Verify whether the data has been completely and accurately migrated. Implement the new API in stages to minimize disruptions.

Vendor Reputation and Support

Enterprises should look for vendors with a proven track record in reliability and performance. Your business should ensure that the chosen vendor offers robust customer support and timely assistance through multiple channels for the integration process. They should also offer comprehensive documentation to ease the integration process.

Testing and Validation

Develop test scenarios for different transaction volumes, data types, and API functionalities. Test all features of the new API and verify that the API provides accurate exchange rates and integrates well with your systems.

Assess the API’s performance for high request volumes or varying network speeds. Ensure it meets your enterprise’s performance requirements. Also, collect end-user feedback to identify any issues or areas for improvement.

Maximizing Value with the Right Currency API

The right currency API enhances your enterprise operations by leveraging advanced features with a cost-effective approach. Here is how enterprises can maximize the value of a currency API:

- Cost-Effectiveness: The Currency APIs come with various pricing models. Assess and compare the pricing model that aligns best with the usage patterns. Some APIs offer free pricing plans but charge for additional features. Ensure that the API accommodates your enterprise needs and does not have any additional costs.

- Advanced Features: The API should provide access to historical exchange rate data and other real-time currency exchange rates crucial for enterprises to meet operational requirements. The API should also support a broad range of currencies, bulk conversions, and historical conversion data.

Currencylayer: A Comprehensive Solution for Enterprises

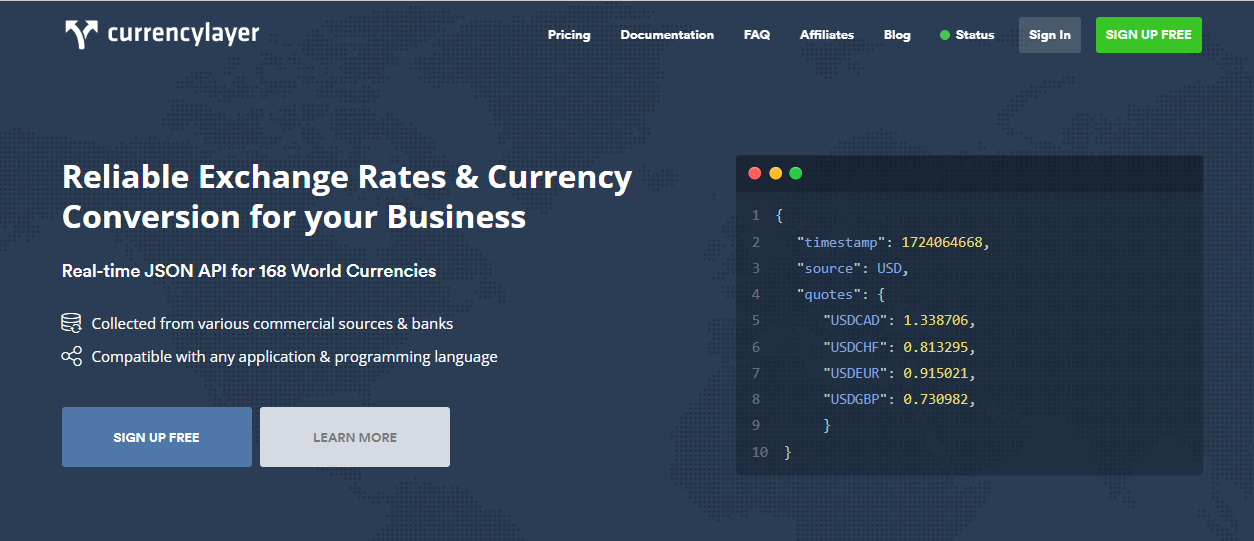

Cyurrencylayer is a real-time JSON API for your enterprises with 168 global currencies. It provides exchange rates and currency conversions to streamline your enterprise operations.

The API collects data from commercial sources and banks to deliver accurate currency exchange data to business development management specialists. The API is compatible with all programming languages and can be integrated into any application.

Premium Features

- Reliable Forex Rates: The API provides accurate exchange rates with the latest information, updated as frequently as 60 seconds to 60 minutes.

- 256-bit HTTPS: The API encrypts data streams via industry-standard 256-bit HTTPS while connecting to the API to ensure the security of the enterprises.

- Advanced Features: The API offers historical rates, currency conversions, currency change parameter tracking, and more advanced features.

- Easy-to-integrate API: The easy-to-integrate API delivers the results in JSON format for maximum usability with any of the applications.

- Interactive Documentation: The Currencylayer provides interactive documentation for developers to explore and test the API features. The documentation also has code examples, which makes implementation easier.

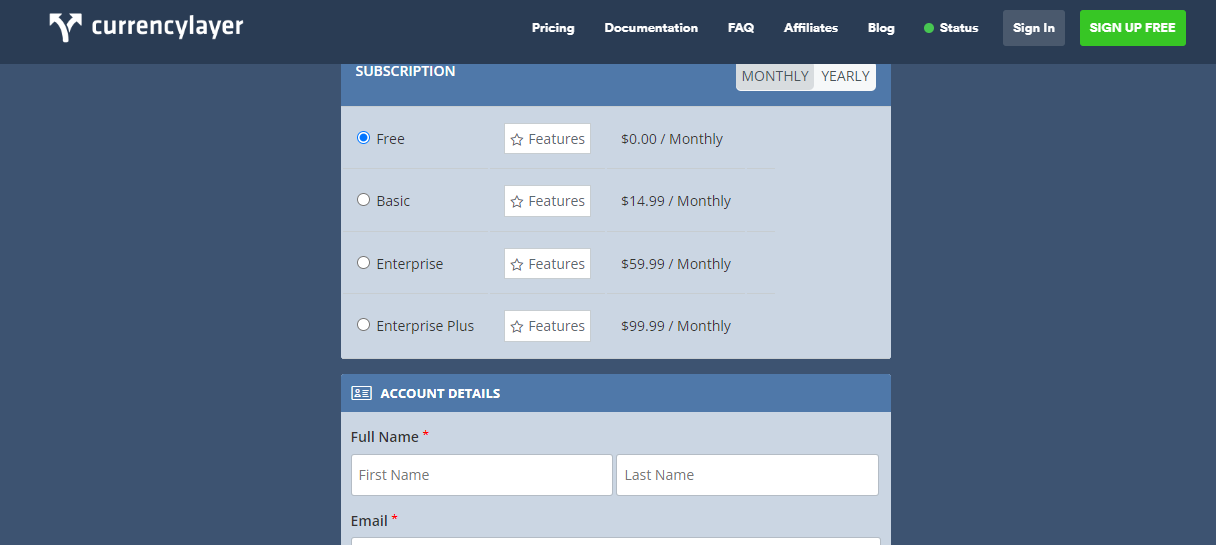

- Easy on your Budget: The API is available with a free tier pricing plan. The specialists can upgrade to Basic, Pro Plans, Business Plus, and Volume pricing plans for added functionality.

- World-Class Tech Support: Currencylayer offers world-class tech support to business development management specialists and developers. The support team is always there to provide the information and assistance you need promptly.

- Extended Usage Statistics: The API lets enterprises track usage daily or monthly and sends automatic notifications as they approach limits.

Integrating Currencylayer API into Apps or Websites

Follow this step-by-step procedure to integrate Currencylayer API into the apps or websites:

1) Sign Up Free for an account on Currencylayer’s official website:

2) Get the API key after signing up to make an API Request.

3) Authenticate Currencylayer API with the access key and make your first API request.

| https://api.currencylayer.com/live ? access_key = YOUR_ACCESS_KEY |

Step 4: The Currencylayer API will return the response in JSON format.

| { “success”: true, “terms”: “https://currencylayer.com/terms”, “privacy”: “https://currencylayer.com/privacy”, “currencies”: { “AED”: “United Arab Emirates Dirham”, “AFN”: “Afghan Afghani”, “ALL”: “Albanian Lek”, “AMD”: “Armenian Dram”, “ANG”: “Netherlands Antillean Guilder”, […] }} |

Case Studies: Enterprises Who Have Integrated Currencylayer API

An enterprise struggled with managing accurate currency conversions for its international transactions. The existing system was not able to keep up with the high volume of real-time updates required for seamless pricing and transactions across various currencies.

The company integrated Currencylayer API to handle real-time currency conversions. The API’s advanced features, such as high-frequency updates and support for multiple currencies, helped the enterprise maintain accurate pricing and smooth transactions.

- Improved Accuracy: The real-time data provided by Currencylayer ensured that currency conversions were accurate and up-to-date.

- Operational Efficiency: Streamlined the currency conversion process and reduces the chances of manual errors.

- Enhanced Analysis: The API provided access to detailed historical data for making informed investment decisions.

Currencylayer: The Best Currency API for your Enterprise Needs!

Currencylayer is a premier choice for enterprises seeking a robust currency API solution tailored to their complex needs.

The API comes with advanced features that offer enterprises accurate and real-time currency data. Explore Currencylayer on the APILayer Marketplace for seamless integration into your applications and enhance your enterprise’s financial management capabilities.

Conclusion

Choosing the right currency API for your enterprise is vital in imparting financial accuracy in currency conversions. APIs such as Currencylayer is among the most reliable API with high data accuracy, performance, and security features. It provides a comprehensive solution to enterprises for handling currency data. You can search the API at the APILayer marketplace and make informed decisions for your enterprise needs.

FAQs

What is currency data API?

A currency data API is a service that provides developers and businesses access to currency exchange rates. The API makes integrating currency conversion into applications and websites easy. This is the reason why businesses utilize the currency data API to manage their currency needs, such as tracking transactions more effectively.

How can I ensure the accuracy of the exchange rates provided by a currency API?

Currency APIs source data from central banks and other reliable financial institutions. The exchange rate data is updated to the API in real time, which ensures that the exchange rates provided by a currency API are accurate.

What security measures should I look for in a currency API?

Strong encryption, two-factor authentication, transport layer security, role-based access controls, and secure API endpoints are some of the measures you should look into for comprehensive protection in a currency API.

How do I evaluate the cost-effectiveness of a currency API?

You can evaluate the cost-effectiveness of the currency API by comparing the API pricing structure, assessing its features, considering the API performance, and the expected volume of requests.

Is there a free currency API?

Yes, various free currency APIs are available in the marketplace, such as Currencylayer API, Fixer.io, and more. The Currencylayer API offers a free pricing plan with basic features and limited access. You can upgrade this plan to Basic, Pro Plans, Business Plus, and a Volume tailored to fit your business needs.

📚 Explore More API Guides

- 7 Best Free Currency Converter APIs in 2025

- 12 Best Financial Market APIs for Real-Time Data in 2025

- Build a Real-Time Currency Converter with Fixer API